6

Results for “-

What Is Rental Income Tax? Rental income tax is the tax on profits you earn from renting out property. It applies to both residential and commercial properties, and even certain movable assets like machinery and ships. In Malaysia, this income is taxable under the Income Tax Act 1967, either as business income (Section 4(a)) or…

-

Tax Investigation v.s. Tax Audit Tax investigation is one of the most intensive enforcement actions undertaken by the Inland Revenue Board of Malaysia (IRBM). Unlike routine tax audits, investigations delve deeply into a taxpayer’s financial records, including personal and business accounts, to uncover any discrepancies, omissions, or potential tax evasion. For businesses and individuals, the…

-

In Malaysia, the Inland Revenue Board of Malaysia (IRBM) or Lembaga Hasil Dalam Negeri (LHDN) has the authority to check and request documents from businesses and individuals to ensure compliance with tax regulations. A tax audit is one of the methods they use to verify that taxes are reported accurately. For business owners, this can…

-

In Malaysia, employers bear significant responsibilities in salary reporting and tax management, and the Form E and Form EA are crucial documents during the annual Malaysia tax filing process. However, many businesses and employees are unsure about the purposes, Form E and Form EA submission requirements, and tax implications of these two forms. Therefore, understanding…

-

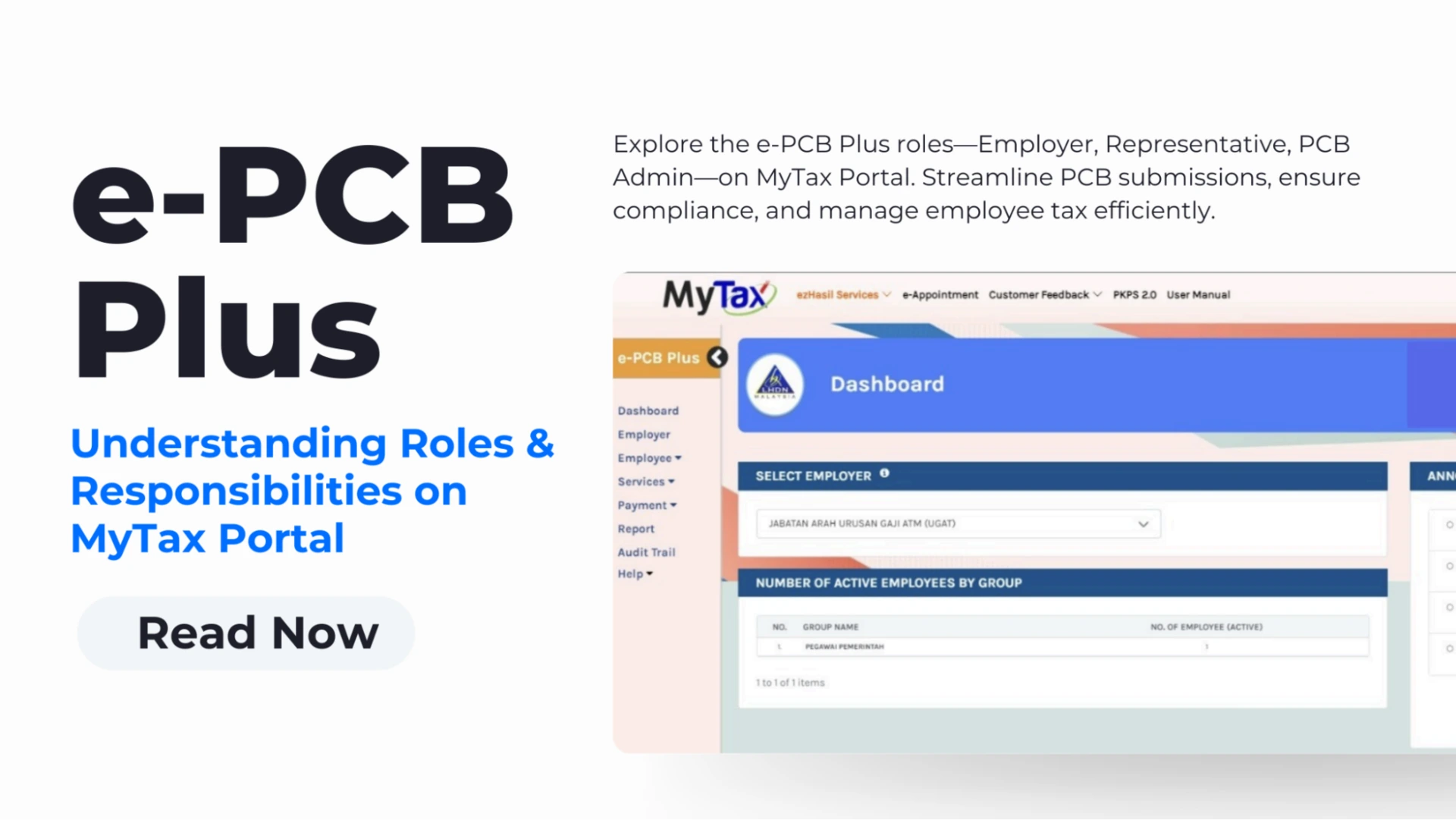

Malaysia’s Inland Revenue Board (LHDN) has recently introduced the e-PCB Plus system, a comprehensive upgrade designed to streamline the monthly tax deduction (PCB) process. This unified platform replaces the previously separate systems, including e-PCB, e-CP39, and e-Data PCB, now accessible under a single interface within the MyTax Portal. Here’s a guide to understanding the various…

-

If you’re earning more than RM6,000 a month, you could significantly reduce your taxes by leveraging the personal income tax reliefs available in Malaysia. From PRS Malaysia contributions to EPF Malaysia and SOCSO contributions, here’s how you can save up to RM570 or more in taxes for the year of assessment 2024. 1. What is…