Tax Expert Articles and Tips for Businesses and

Individuals in Malaysia

Explore in-depth articles on various tax-related topics in Malaysia. Gain valuable insights and tips to manage your taxes efficiently, whether you’re an individual or a business owner in Malaysia.

Published on: December 26, 2024

Detailed Guide to 2025 Lifestyle Tax Relief in Malaysia

Malaysia’s 2025 lifestyle tax relief allows taxpayers to save on their personal income tax by claiming deductions for specific personal and…

View More

Published on: December 24, 2024

Comprehensive Guide to 2025 Personal Tax Relief in Malaysia : Maximise Your Income Tax Savings

As the new assessment year approaches, understanding the personal tax relief measures for the year of assessment 2025 in Malaysia can…

View More

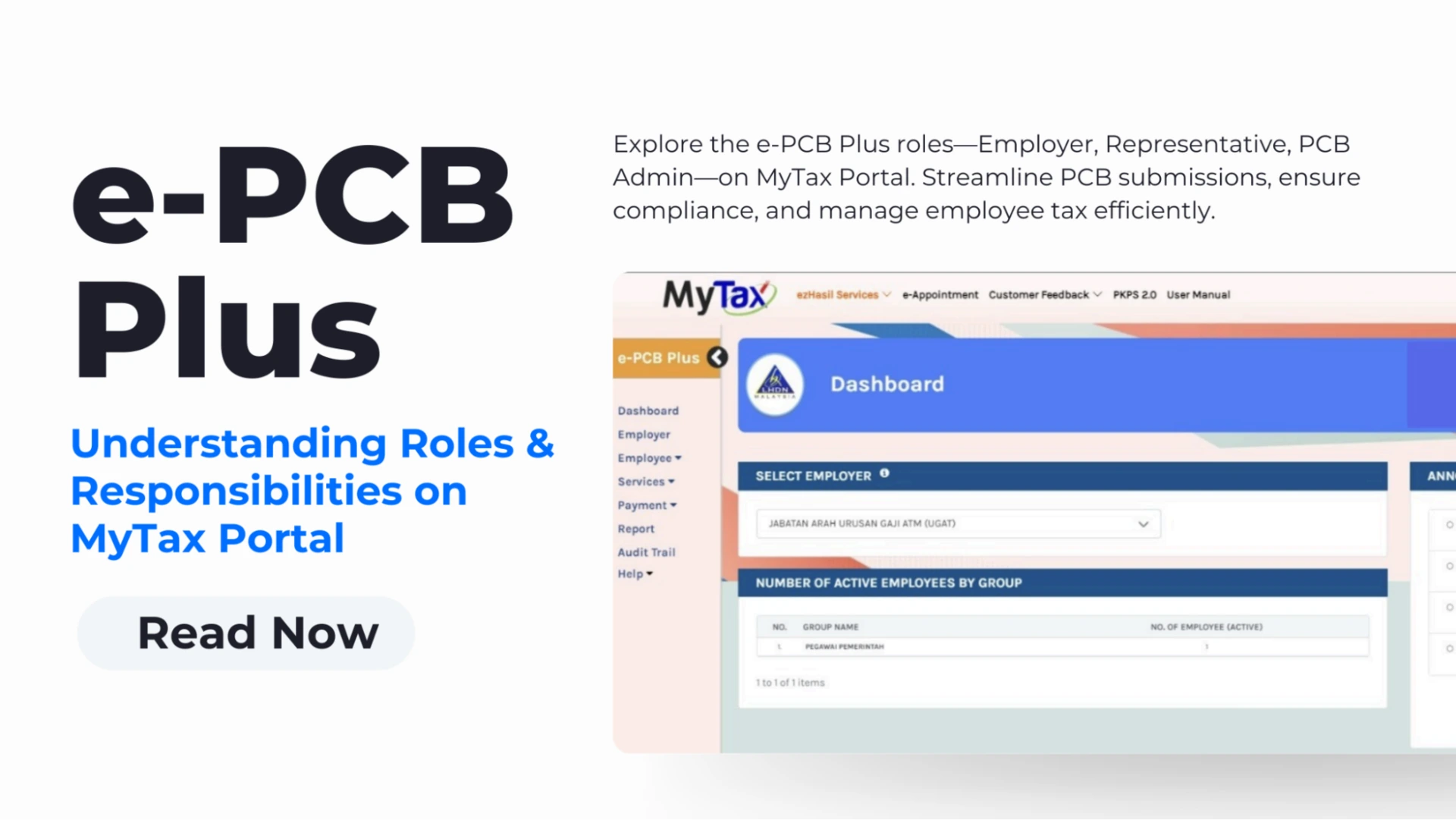

Published on: December 19, 2024

Understanding Roles and Responsibilities in the New e-PCB Plus System on MyTax Portal

Malaysia’s Inland Revenue Board (LHDN) has recently introduced the e-PCB Plus system, a comprehensive upgrade designed to streamline the monthly tax…

View More

Published on: December 10, 2024

SST Malaysia 2024: A Complete Guide by YYC taxPOD

Master Sales and Service Tax (SST) Malaysia with YYC taxPOD: Stay Compliant, Stay Ahead Understanding and complying with Malaysia’s Sales and…

View More

Published on: October 21, 2024

Budget 2025: Introducing 2% Dividend Tax on Dividend Income Exceeding RM100,000 in Malaysia

The 2% tax on dividend income exceeding RM100,000 annually, introduced in Budget 2025 Malaysia on 18 October 2024, has come as a surprise…

View More

Published on: October 11, 2024

YYC Tax Directors and Experts Share Their Malaysia’s National Budget 2025 Wishlist

As Malaysia anticipates the announcement of the National Budget 2025 Malaysia, businesses and individuals are looking for key tax reforms that…

View More