e-invoicing Malaysia Made Easy with YYC taxPOD’s e-invoicing Course

Stay ahead of the curve with YYC taxPOD’s comprehensive e-Invoice Malaysia Masterclass. Our 5 expertly designed modules will take you from understanding the basics to implementing seamless e-invoicing solutions across your business.

Why Join this e-invoicing Course?

- Simplify compliance with LHDN e-invoice regulations.

- Explore practical e-invoicing solutions for industry-specific challenges.

- Gain actionable insights from Malaysia’s leading tax professionals.

Your journey to smarter e-invoicing starts here.

Your Complete 5-Module Guide to

E-Invoicing in Malaysia

Learn everything you need to know about Malaysia’s e-invoicing requirements with YYC taxPOD’s comprehensive 5-module course. From understanding the basics to mastering compliance, each module is designed to make the process simple, practical, and easy to apply in your business.

Foundations of e-invoicing Malaysia

This introductory module breaks down the fundamentals of e-invoicing, making it easier to grasp the essentials for smooth implementation. Guided by our tax expert, you’ll receive straightforward and accessible insights.

Learning Outcomes:

- Grasp the basic principles of e-invoicing Malaysia.

- Understand the advantages and key benefits of e-invoicing Malaysia.

- Familiarize yourself with Malaysia’s e-invoicing timeline and compliance dates set by LHDN.

- Identify which businesses must implement e-invoicing and its impact.

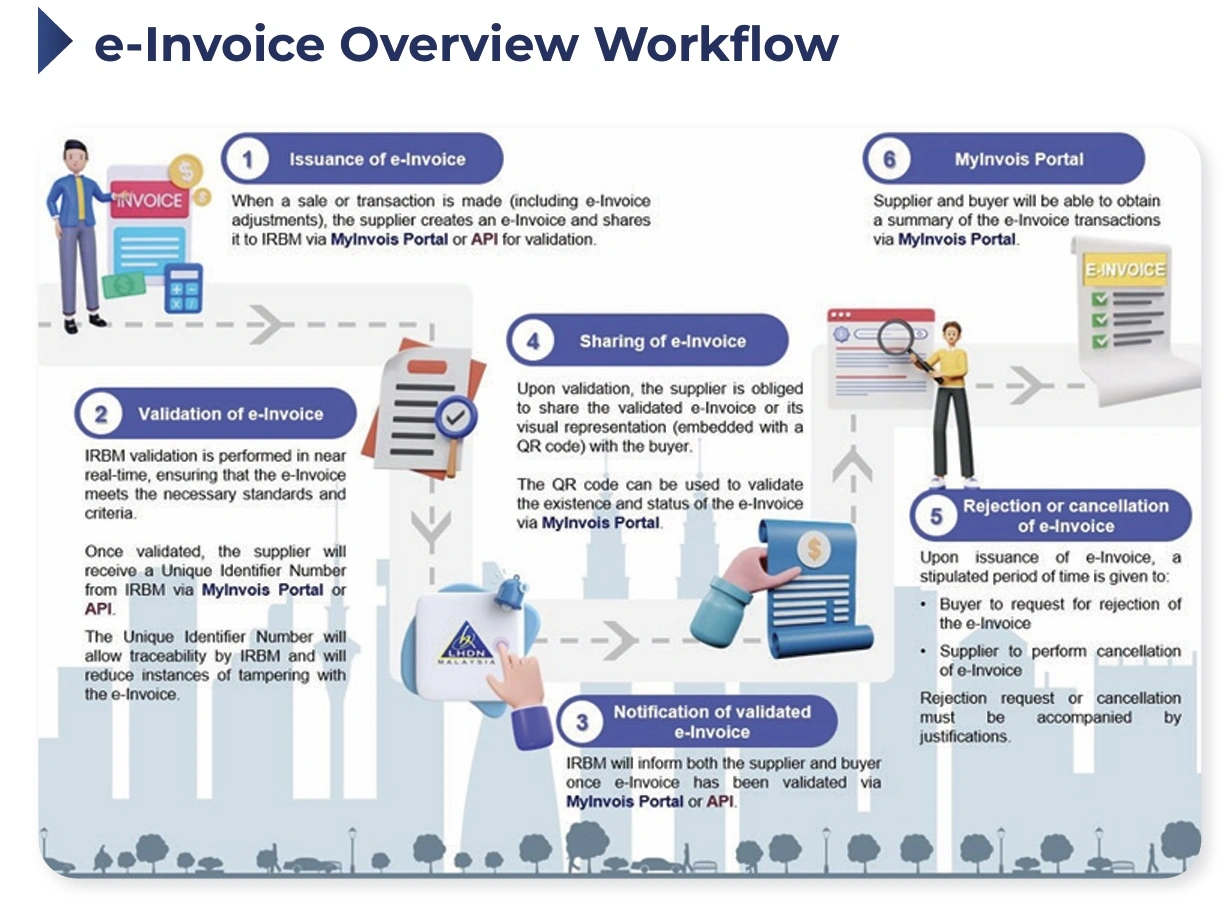

- Follow a detailed, step-by-step process for creating, validating, and submitting e-invoices.

- Recognize situations where e-invoices are essential for documenting income and expenses.

Understanding e-invoice Workflows & e-invoicing Model Variations

In this in-depth session, you’ll examine various e-invoice workflows and model types, gaining strategies to enhance invoicing efficiency.

Learning Outcomes:

- Understand different e-invoicing models and their respective workflows.

- Grasp the pre-submission requirements that are critical for compliance.

- Delve into the role and functionality of Application Programming Interfaces (API).

- Learn which fields are essential within an e-invoice.

- Uncover the details of what is included in an e-invoice Software Development Kit (SDK).

- Assess the pros and cons of each model to determine the best fit for your business.

System Readiness and e-invoicing Assessment with Expert Guidance

This module offers an in-depth look at evaluating your business’s readiness for e-invoicing Malaysia. With expert guidance, you will understand how businesses can issue e-invoices by integrating accounting systems with the MyInvois Portal or Application Programming Interface (“API”) to ensure secure and efficient operations.

Learning Outcomes:

- Begin with APIs that are essential to e-invoicing systems.

- Gain a clear understanding of e-invoicing Malaysia within the API framework.

- Explore how the LHDN direct API integrates with POS and accounting systems.

- Learn how to issue standard, self-billed, and consolidated e-invoices using accounting software

e-invoicing Malaysia Scenarios & Types of Transaction Management

This module dives into different e-invoicing scenarios and effective e-invoice solutions for managing diverse transactions, helping you address complex invoicing needs.

Learning Outcomes:

- Understand the concept and practical applications of consolidated e-invoicing.

- Explore periodic issuance of statements or bills.

- Learn the requirements around e-invoicing for foreign income.

- Discover situations where e-invoices apply to out-of-pocket expenses.

- Manage employee claims effectively through e-invoicing.

- Investigate scenarios for self-billed e-invoicing to improve transaction management.

Strategies for Implementing e-invoicing in Your Business

Covering essential strategies for compliance, this module equips businesses with the knowledge to meet e-invoicing regulations and optimize processes. Learn how to align accounting practices and implement e-invoicing across diverse scenarios for a seamless transition.

Learning Outcomes:

- Familiarize yourself with the regulations governing e-invoicing Malaysia.

- Review and adapt Accounts Receivable/Accounts Payable processes to align with e-invoicing standards.

- Engage in practical, scenario-based applications of e-invoicing across various business situations.

- Develop a preparation and implementation plan tailored for each department in your business.

YYC taxPOD e-invoicing Course Video Series

Tailored e-invoicing guidance for key industries with more industry-focused series are on the way.

Healthcare e-invoicing

Gain detailed insights into how e-invoicing impacts the healthcare industry, including dual billing, invoicing for consulting services, and rental spaces within hospitals.

e-invoicing for Construction

Examine the role of e-invoicing in the construction industry, focusing on aspects like progress claims and industry-specific compliance practices.

e-invoicing in E-Commerce

Understand the responsibilities of consumers, platforms, merchants, and service providers in managing e-invoices within the e-commerce sector.

Who Should Join the YYC taxPOD e-invoicing course Malaysia?

The YYC taxPOD e-invoicing course Malaysia is ideal for:

Business Owners

Gain essential knowledge on complying with e-invoicing requirements.

Finance &

Accounting Teams

Learn to manage and validate e-invoice format efficiently.

SMEs

Transition smoothly to MyInvois Portal or API integration models.

Tax Consultants

Stay updated to better advise clients on e-invoicing Malaysia regulations.

Master e-invoicing Malaysia with Confidence, Enroll in YYC taxPOD’s Expert-led e-invoicing Course Today!

Transform your business with YYC taxPOD’s comprehensive e-invoicing Malaysia modules, designed to guide you through every step of the e-invoicing process.

e-invoice Meaning in Malaysia

The term e-invoice in Malaysia refers to a digital document that captures the details of a transaction between a supplier and a buyer. It replaces traditional paper or simple electronic formats like PDFs, ensuring that the invoice is created in a structured format (XML or JSON) that can be validated automatically by the Inland Revenue Board of Malaysia (IRBM)

e-invoicing Malaysia: How does it Work?

Under Malaysia’s new e-invoicing system, an e-invoice must include essential transaction information such as the supplier’s and buyer’s details, item descriptions, quantities, prices, and applicable taxes. The document also incorporates a QR code for verification and compliance tracking, enhancing transparency and efficiency. This system aims to streamline tax administration and reduce errors commonly associated with manual invoicing.

e-invoice Malaysia: Penalty for Non-Compliance

Businesses in Malaysia that fail to comply with the e-invoicing mandate may face penalties under the Income Tax Act 1967. These can include fines ranging from RM200 to RM20,000 per transaction and potential imprisonment of up to six months, or both.

e-invoicing Malaysia Concession Period for Compliance

Adapting to e-invoicing Malaysia is now simpler with the six-month concession period offered by IRBM. This grace period is designed to support businesses as they transition to the MyInvois Portal, ensuring smooth adoption without immediate pressure.

- No Individual E-Invoices Required: During this period, businesses can issue consolidated e-invoices, even if requested otherwise.

- Extended Timeline for Large Businesses: Companies with an annual turnover above RM100 million, required to comply by August 1, 2024, benefit from an extended concession period until early 2025.

Need Help? Start Here

Frequently Asked Questions

Browse the most common questions we receive and find answers to help you better understand how taxPOD works.

Find more about Malaysia’s e-invoicing implementation overview.

1. MyInvois Portal

This is a user-friendly platform developed by the Inland Revenue Board of Malaysia (IRBM) specifically for micro, small, and medium-sized enterprises (MSMEs). The MyInvois Portal allows businesses to manually generate, submit, and validate e-invoices without needing advanced technical infrastructure. It’s an accessible and cost-effective option for businesses with lower invoice volumes. However, it may not be ideal for companies that handle high transaction volumes as it lacks automation.

2. API Integration

This model is suitable for larger businesses that require automated and real-time invoicing capabilities. API integration allows companies with established Enterprise Resource Planning (ERP) systems to connect directly with the MyInvois system. Through this setup, invoices are automatically generated, submitted, and validated, minimizing manual intervention and increasing efficiency. However, this method requires significant IT resources and may involve higher costs for system updates and maintenance.

3. e-invoicing Middleware

For businesses that prefer not to overhaul their existing systems, e-invoicing middleware solutions act as intermediaries, connecting current ERP or accounting systems to the MyInvois portal. This approach minimizes disruption and ensures compliance without requiring extensive system modifications. It’s a flexible solution but may involve reliance on third-party providers for updates and maintenance.

4. PEPPOL Network

Malaysia is exploring integration with the PEPPOL (Pan-European Public Procurement On-Line) network, which is beneficial for companies engaged in international trade. This model supports cross-border transactions and may become a critical component for global business compliance in the future. Currently, it is not mandatory but represents a forward-looking option for businesses dealing with international partners.

These integration models provide flexibility for businesses of various sizes, ensuring that all can meet the e-invoicing compliance requirements based on their operational needs.

How to Start with the MyInvois Portal Testing Environment

Access the Testing Environment: Log in to the MyInvois portal via the pre-production URL (preprod-mytax.hasil.gov.my) using your MyTax credentials.

Set Up User Access: Configure user permissions and roles for those who will manage and submit e-invoices in your organization.

Upload Sample Data: Utilize the test environment to upload sample invoice data in the required XML/JSON format to ensure compatibility and correct submission processes.

Validate and Review: Submit the test invoices to see how they are processed. You can check for validation errors and make adjustments accordingly.

Test the Full Workflow: Simulate real transactions by generating and validating e-invoices to become familiar with the portal’s interface and functions.

For a comprehensive step-by-step guide on using the MyInvois portal, check out this article.

Additionally, for comprehensive insights into e-invoicing queries and exemptions, check out this detailed e-invoicing FAQ article on taxPOD.com.my.

For further assistance tailored to various industries and comprehensive solutions, explore this article on e-invoicing challenges and solutions from taxPOD.